Insurance is changing… and so are its jobs

In 2020, we have published a study identifying the changes in skills within the insurance sector in the face of the various transformations at work. The study highlighted five major trends that lead traditional companies, but also the insurtechs, to rethink the key skills within each business. A year later, is the impact of digitalisation on the management professions more important? Which key skills and tools should be developed to remain competitive?

Summary

The 4 major trends transforming the industry

The impact of digitalisation on management and customer relations jobs

Business case: how a mutual insurance group supports the evolution of management professions

The 5 major trends transforming the industry

Affected by the transformations, the historic insurance firms must imperatively develop their services and assistance offer if they want to remain on the market. There are five main trends impacting the entire insurance value chain:

- Development of digital tools

- Data revolution

- Emergence of new risks

- Numerous modern requirements

- Regulatory changes

The impact of digitalisation on management and customer relations jobs

According to the Association for the Employment of Executives (fr. APEC), “60% of employees (Ed.: in the insurance sector) work in customer relations: sales, contract management, claims settlement” (2017). This is why we have decided to focus on the impact of new trends on the contract and claims management professions within the industry’s historical companies.

The digital wave has become a real opportunity for the management professions. Thanks to the appearance of numerous digital tools, certain processes are already being automated and distribution channels are multiplying. Managers will then be able to devote more time to accompanying their clients and better meeting their requirements.

Let’s take Robotic Process Automation as an example. RPA facilitates claims management while requiring the mastery of these tools. For instance, the WeProov application from Natixis Assurances allows a policyholder to declare a minor car claim completely autonomously thanks to his smartphone. Nothing could be simpler than taking a photo of your vehicle, signing the digital report and sending it to your expert.

Source : Argus de l’assurance

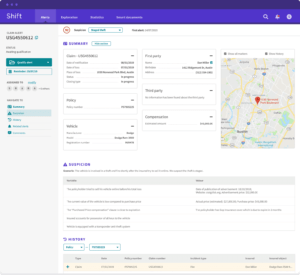

Another example is the automatic fraud detection offered by Shift Technology. By building an algorithm that detects fraud “using data and documents”, Shift Technology’s solution allows insurance professionals to focus on supporting their customers thanks to the time saved previously dedicated to managing contracts and claims. Today, its clients include the historical players such as Axa, Harmonie Mutuelle and Covéa.

Source : Shift-technology.com

Business case: how a mutual insurance group supports the evolution of management professions

How can an organisation foresee the impact of a trend on a particular job and support its employees in the changes to come?

This is where Strategic Workforce Planning comes in. This business and HR process encourages teams to think together about future job evolutions in the face of trends that are transforming the sector.

Akoya supported one of its clients, a mutual insurance group, in their reflection on the impact of digitalisation and of a high relationship value model on the Customer Management and Relation professions (6 000 employees). This study was at the origin of the first Strategic Workforce Planning exercise for the Customer Management and Relation business lines conducted at the Group level.

Akoya’s answer can be summarised in three points:

- Scenario definition around 2 axes: creating a model with high relational value and automation of certain activities

- Identification of the principal movements in workforce caused by the above scenarios and definition of 5 key skill areas to be developed or introduced

- Training of HR staff of the Group and Mutual Insurance Companies on our SWP Albert tool to ensure the sustainability of the approach

For further information...

Download the study about the (r)evolution of the insurance industry (available in French)Our business cases

HR strategy in the Mutual sector

How to support the group’s strategy with an actionable HR strategy?

I want to know moreMonitoring and development of well-being in the banking sector

How to develop employee experience in a context of strong growth and increased pressure on teams?

I want to know more